Democrats have warmly embraced the idea of student loan forgiveness and seem ready to make it a key political issue both now and during the fall midterms. And a new I&I/TIPP Poll shows why: On the whole, Americans like the idea, despite its potential drawbacks.

The May I&I/TIPP Poll asked 1,320 adults nationwide four questions about student loan forgiveness; the intention was to gauge whether there was broad-based support for the idea. It was based on White House plans, still in the discussion stages, to forgive student loans up to either $10,000 or $50,000.

The poll, taken online from May 4-6, has a margin of error of +/- 2.8 percentage points.

Among those queried, 61% said they would “strongly” (40%) or “somewhat” (21%) support a plan for forgiving student loan debts of up to $10,000 for “all Americans.”

Just 30% said they would oppose such a move either “strongly” (20%) or “somewhat” (10%). “Unsure” received a 9% response.

The support was high, though not broad, varying considerably by age, race and political affiliation.

For instance, in general, older Americans don’t like the idea of student loan forgiveness. For those 18-24, a strong majority (72% “support” vs. 13% “oppose”) like the idea. For those 25-44, the comparable numbers were even higher, 78% support and 16% oppose.

But for those 45-64, support drops off to 54%, while opposition rises to 37%. And for those over 65, just 42% favor student loan forgiveness, while 51% oppose it.

Another split emerges by race. Among whites, 57% support the idea, while 36% oppose it. Among blacks and Hispanics, support is far higher at 72% support and 17% oppose.

Perhaps the least surprising result is by party affiliation: Democrats (80% support, 13% oppose) overwhelmingly like the idea, while independents (61%-33%) are also strong supporters, though with much higher opposition than the Democrats.

As for Republicans, just 41% support it and 53% oppose it.

One surprising outcome: Those having a high school diploma or less supported it 65%-24%, highest of any education group. That compares to 56%-33% for those with “some college” and 63%-33% for those with a college degree or higher.

We asked a follow-up: How about forgiving not $10,000 but $50,000 in student debts for all Americans?

While still favored by most, the margin narrowed. Just 53% supported it, while 38% opposed it. And almost across the board, support by each key demographic softened when the amount of debt forgiveness was increased.

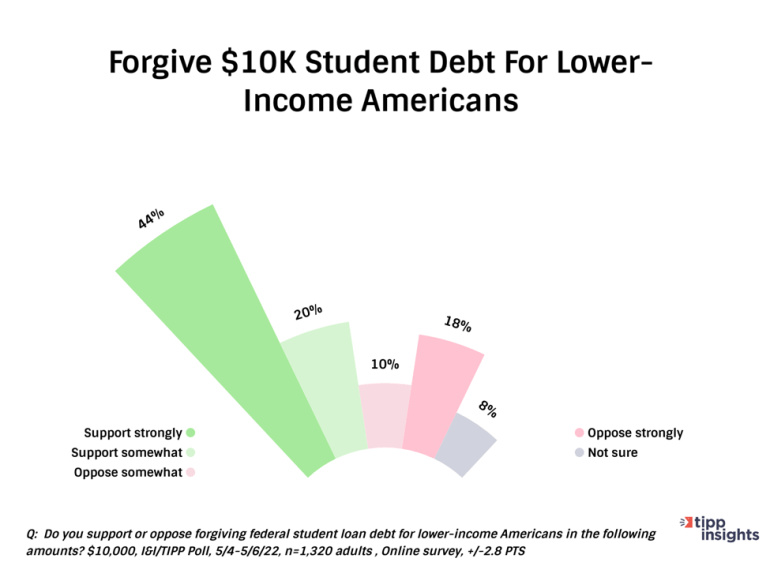

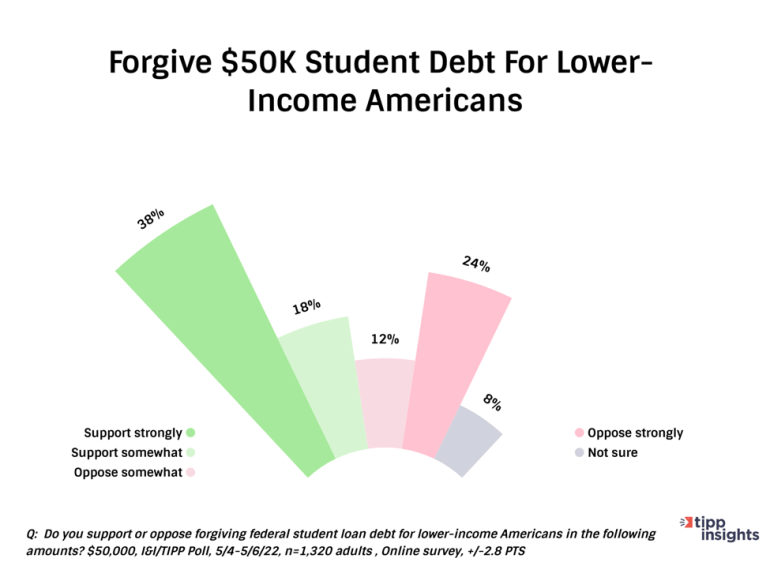

The I&I/TIPP Poll then threw a curveball, asking respondents: “Do you support or oppose forgiving federal student loan debt for lower-income Americans in the following amounts?” The question was asked for both the $10,000 and $50,000 debt-relief levels.

Recall that the earlier questions asked about debt relief for “all Americans.”

Support increased when relief included only lower-income debtors, but not by much. At $10,000 of relief, 64% said they’d support forgiving loans for lower-income debtors, while 28% said they’d oppose it. That’s fairly close to the 61%-30% favoring giving “all Americans” relief.

And, again, raising the relief amount to $50,000 for lower-income Americans raises support only slightly to 56%-36%, compared to 53%-38% for “all Americans.”

It’s clear many Americans see this as relief for the middle class as much as for low-income Americans. That might affect how it’s sold politically, increasing chances for a broad-based forgiveness plan.

While economists generally agree that debt forgiveness is a questionable idea at best, the idea seems to have caught on with the public. Today, 43 million Americans over the age of 18 have student debts totaling an estimated $1.75 trillion, or roughly $28,950 on average. It’s not hard to see the appeal for many.

Of the total amount in loans, 92% were made by the federal government. Just 8% by private banks. So this is largely a federal, not a private, problem. Like it or not, Washington will come under intense political pressure, as it often is, to “do something.”

The cost to the taxpayers will be considerable. At $10,000 in forgiveness, it costs federal government $377 billion, covering 24% of all student debt. Increase forgiveness to $50,000, and cost jumps to $759 billion, erasing 67% of all debt.

Expect big debate over fairness.

A study by the left-center Brookings Institution noted “that almost a third of all student debt is owed by the wealthiest 20% of households and only 8% by the bottom 20%. Across-the-board student loan forgiveness is regressive measured by income, family affluence, educational attainment – and also wealth.”

Another study by the University of Chicago found that the benefits of debt relief go to the richest households. That study calculated that the top 30% of U.S. households would get nearly half of all the loan forgiveness. Those in the bottom half would get just a quarter of the relief in dollar terms.

Ironically, the current student debt payment relief enjoyed by 24 million American student-debt holders was passed by the Republican Congress in 2020, and signed into law by then-President Donald Trump. So, like Democrats, Republicans understand this is a potent political issue.

Even so, Republicans generally object to sweeping forgiveness of student loans, as recently proposed by President Joe Biden, Sen. Elizabeth Warren, and others in the progressive wing of the Democratic Party.

“Student loan socialism would be a giant slap in the face to every family who sacrificed to save for college, to every graduate who paid their debt, to every worker who made a different career choice so they could stay debt-free,” Senate Minority Leader Mitch McConnell said recently.

And an even larger question of fairness looms.

“Forgiveness proposals would unfairly foist a borrower’s debt onto strangers, including those who made a conscious decision not to attend college to avoid debt or to go to a school they otherwise wouldn’t have because it was less expensive,” wrote Lindsey M. Burke, director of conservative-leaning Heritage Foundation’s Center for Education Policy. “At the same time, it would almost certainly lead to the cost of college increasing for future students.”

Each month, I&I/TIPP publishes timely and informative data from our polls on this topic and others of interest. TIPP has earned a reputation for excellence by being the most accurate pollster for the past five presidential elections.

Terry Jones is an editor of Issues & Insights. His four decades of journalism experience include serving as national issues editor, economics editor, and editorial page editor for Investor’s Business Daily.

Using these vague “policy violations,” Google is now threatening to demonetize us. It’s part of Big Tech’s effort to silence conservative voices.

Using these vague “policy violations,” Google is now threatening to demonetize us. It’s part of Big Tech’s effort to silence conservative voices.

something is happening here

But you don’t know what it is

Do you, Mister Jones?

[Bob Dylan: Ballad of a Thin Man]

It is called buying votes. Julius Caesar used to do it, with his own money in ancient Rome. Always popular with those getting the money. The Democrat party has perfected it using the public purse. GOP politicians are blind to it these days, almost naive, so it goes on and on in varied guises.

Like the $300 per child giveaway or the bonuses above wages for being unemployed (Senator Graham saw it, but did not recognize it for what it was). Or in California, the special commission that voted for race-based reparations (rewards for reliably voting Democratic). Or the woke cities giving monthly payouts (probably to create party activists addicted to money flowing from the Party of Largess). It is vote buying, pure and simple, no matter how you slice and dice it. Good politics for Democrats: who will use it to rally their minions and take credit for wanting to do it even if it never happens; and blame the GOP, Trump, Putin or the demon de jour for stopping it.

Student loans are a choice made by an individual. It was not a necessity , like a house loan, or car loan to access work. That those who themselves could not, or chose not to attend a university, should be expected to spend their hard won $$$ to clear someone else’s debt, is unfair and ludicrous. To demand this in the midst of inflation, is egregious. As the article points out, the majority of students come from well off families, who will not be worrying about putting basic food on the table.

Then there is the question; exactly how many of these students are now able to get a job for themselves ? Were these college degrees worth the paper they were printed on ? Judging from graduates met online, college was the ultimate goal—no necessity to follow through . And just how many Sociology positions are there in the real world ?

This is simply another Marxist concept, no doubt hatched with the loftiest intent, but will benefit the elite more than the ‘hood.

How about subsidising the farming industry, so as to gain food independence with the same ill afforded money spent on partying, drug riddled students.

Not so certain this is accurate.

I generally try to peruse news sites that allow comments, as the comments are sometimes more relevant than the news content. Of the ‘student debt relief’ articles I’ve read in the last few cycles, the comments were overwhelmingly against loan forgiveness. Not even close, perhaps 80% or greater are opposed (this is not only Fox News, but also ABC, Yahoo. whoever else allows comments).

Forgiving student loans is just another liberal giveaway. These loans were signed for and agreed to by the students. Regardless of the loans “fairness” they are legal debts and I, for one, am not in favor of paying off someone else’s debts because they have over extended themselves.

Who pays back the parents/family of kids who joined the military for education benefits, only to be killed or severely wounded in the wars of the past twenty years?

Why should the taxpayer pay for some communist punks college .It is not fair for those of us who have paid off their loan its no way fair and I really am pissed that they are going to do this I know it has not passed but it will the communists think this will get them lots of votes well they will not get mine.No way no how .

I expect the results would be radically different if if the question was phrased as: “Would you be willing to pay higher income taxes or suffer higher inflation to pay down the student loan debts of others?”

This question is phrased as if the lender is the one getting stuck with the tab. We all know the lender will be made whole. Taxpayers (or more likely, holders of US dollars) will be the ones picking up the tab. The Fed will just print more money to pay these down.

I guess I’m a sucker for paying off my student loans…

So I put myself through a University and worked instead of a loan to pay for it. Can I get $10K in free cash to offset the money I paid for my higher education? Wish I had known this when I went to university. I could have had a lot more fun instead of holding down a full time job and maintaining a full class load to graduate with a 3.98 GPA and earn my degree. I could use $10 grand right now to pay my food and fuel bills.

I wonder how the results would come out if you framed the poll by asking which taxpayers should have to pay for the loans that would be forgiven. Where is the fairness in asking a blue collar worker struggling to support his/her family to pay of someone else’s loan?

Recall where the Federal take over of student loans began — with ObamaCare. The student loan program was supposed to produce a surplus to help finance a Federal take over of medical financing. Everything responsible for student loans growing out of sight in a decade will be rewarded and the problem will quickly grow back.

How much misrepresentation and malfeasance is involved here?

What happens to people who paid off their loans? Do they get a rebate? Should all student loan holders stop paying their debts until this sorts out?

I want to see the colleges and universities hold some responsibility as they pad and expand their staffs and pass the costs on to students and their parents, who it looks like, will pass the cost of the loan repayment to the rest of us. Perhaps tax university endowments to pay for some of the loan repayments. Once enacted, there will be calls to forgive loans in the future again.